FYI

Embarking on your stock market journey can feel overwhelming, but fear not! Knowledge is your greatest asset. This post dives into some of the best books to build your understanding of the stock market, whether you’re a complete beginner or looking to refine your strategies. From foundational principles of value investing to practical guides for stock selection and the crucial psychology behind successful trading, we’ll explore the literary resources that can empower you to navigate the exciting world of stocks with confidence. Get ready to turn the page on your financial future!

5 best books for stock market

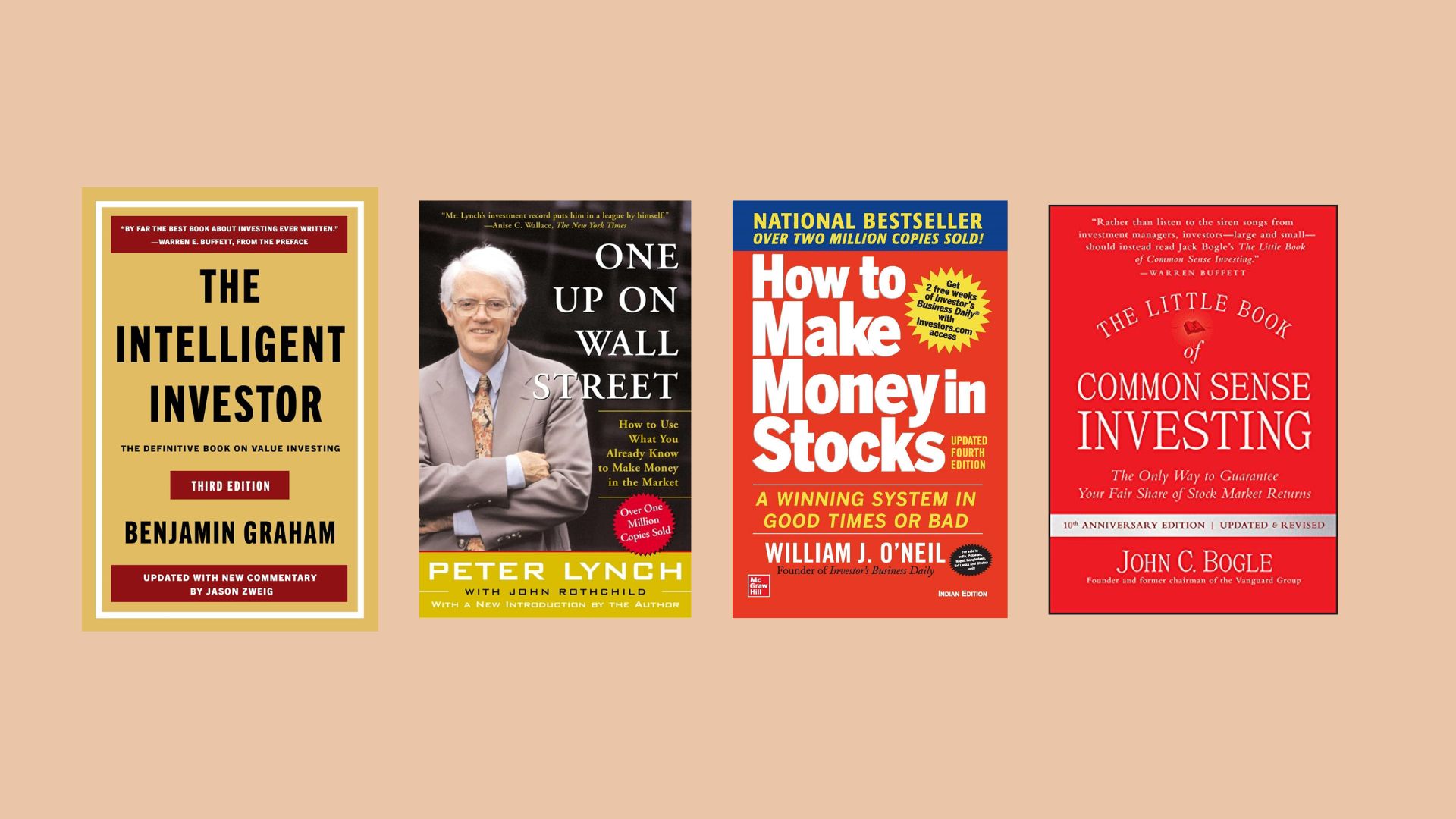

- “The Intelligent Investor” by Benjamin Graham

- “One Up On Wall Street” by Peter Lynch

- “How to Make Money in Stocks” by William J. O’Neil

- “The Little Book of Common Sense Investing” by John C. Bogle

- “The Psychology of Money” by Morgan Housel

5 best books for stock market , review

1. The Intelligent Investor

The Intelligent Investor

By Benjamin graham

Best seller

Benjamin Graham’s “The Intelligent Investor” is a timeless cornerstone for anyone serious about the stock market. Forget get-rich-quick schemes; this book champions a rational, long-term approach rooted in value investing. Graham emphasizes understanding a company’s intrinsic worth, not just its fluctuating stock price.

He introduces the concept of “Mr. Market,” an often irrational business partner representing market sentiment, urging investors to capitalize on his mood swings rather than succumb to them. The book stresses the importance of a “margin of safety” to protect against errors and market downturns. While some examples might feel dated, the core principles of diligent analysis, patience, and emotional discipline remain profoundly relevant, making it an essential read for building a resilient investment strategy.

2. One Up On Wall street

One upon wall street

By peter lynch

Written by a successful former fund manager, this book encourages everyday investors to use their knowledge of familiar companies and industries to find good investment opportunities. Lynch emphasizes common sense and demystifies the stock-picking process, showing how individual investors can outperform professionals by investing in what they know.

Best seller

Peter Lynch’s “One Up On Wall Street” offers a refreshing, accessible perspective on stock picking, encouraging everyday investors to leverage their real-world knowledge. Lynch argues that by paying attention to the products and services we use daily, we can identify promising investment opportunities before the professionals.

He demystifies the stock market, breaking down company categories and offering practical advice on when to buy and sell. The book emphasizes thorough research and understanding a company’s fundamentals, cautioning against blindly following trends. Lynch’s engaging style and relatable examples empower individuals to trust their own insights and potentially uncover “tenbagger” stocks, making it an encouraging and practical guide for both beginners and experienced investors.

3.How to Make Money in Stocks

How to Make Money in Stocks

by William J. O’Neil

This book introduces the CAN SLIM investment system, a combination of fundamental and technical analysis to identify leading growth stocks. It teaches investors how to recognize chart patterns, understand market trends, and pinpoint stocks with strong earnings potential. It’s a practical guide for those interested in a more active investment approach.

Best seller

William J. O’Neil’s “How to Make Money in Stocks” presents the CAN SLIM system, a structured approach blending fundamental and technical analysis for identifying high-growth stocks. This isn’t about slow and steady; O’Neil focuses on finding leading companies with strong earnings growth, new products, or services poised for significant gains.

The book meticulously details each letter of CAN SLIM, providing clear criteria for stock selection, from current quarterly earnings to supply and demand dynamics. It emphasizes the importance of studying stock charts to identify proper buy points and using stop-loss orders to limit potential losses. While requiring a more active approach than value investing, O’Neil’s system offers a disciplined methodology for those seeking potentially rapid returns by identifying and capitalizing on market leaders.

4. The Little Book of Common Sense Investing

The Little Book of Common Sense Investing

by John C. Bogle

Best seller

John C. Bogle’s “The Little Book of Common Sense Investing” is a straightforward and compelling argument for simplicity in the often-complex world of finance. Bogle, the founder of Vanguard, champions the power of low-cost index fund investing as the most reliable path to long-term wealth accumulation for the average investor.

He persuasively demonstrates how high fees and active management often erode returns, advocating instead for broad diversification through index funds that track the overall market. Bogle’s writing is clear and concise, making a powerful case for a passive, buy-and-hold strategy. This book cuts through the noise and offers a practical, evidence-based approach, emphasizing patience and minimizing costs as the keys to successful investing, making it an essential read for anyone seeking a sensible and effective way to build their financial future.

5. The Psychology of Money

The Psychology of Money

by Morgan Housel

This book explores the behavioral aspects of investing and how our emotions and biases can significantly impact financial decisions. Through engaging storytelling, Housel highlights important lessons about wealth, risk, greed, and fear, providing valuable insights into making smarter and more rational investment choices. While not strictly a “how-to” stock market book, understanding these psychological principles is crucial for long-term success in the market.

Best seller

Morgan Housel’s “The Psychology of Money” isn’t a traditional investment guide filled with stock tips, but rather a profound exploration of the often irrational human behaviors that drive our financial decisions. Through compelling stories and insightful observations, Housel reveals how our personal histories, ego, and biases significantly impact our relationship with money and investing outcomes.

He emphasizes that success in finance is less about what you know and more about how you behave, highlighting the importance of long-term thinking, understanding risk tolerance, and recognizing the ever-present influence of luck. This book offers valuable perspectives on wealth building, financial independence, and the crucial distinction between being rich and being wealthy. By understanding our own psychological tendencies, Housel argues, we can make smarter, more sustainable financial choices, making this a crucial read for anyone seeking true financial wisdom beyond mere mechanics.